SSDI vs. SSI: Eligibility Requirements and Benefits

Atticus offers free, high-quality disability advice for Americans who can't work. Our team of Stanford and Harvard trained lawyers has a combined 15+ years of legal experience, and have helped over 10,000 Americans apply for disability benefits.

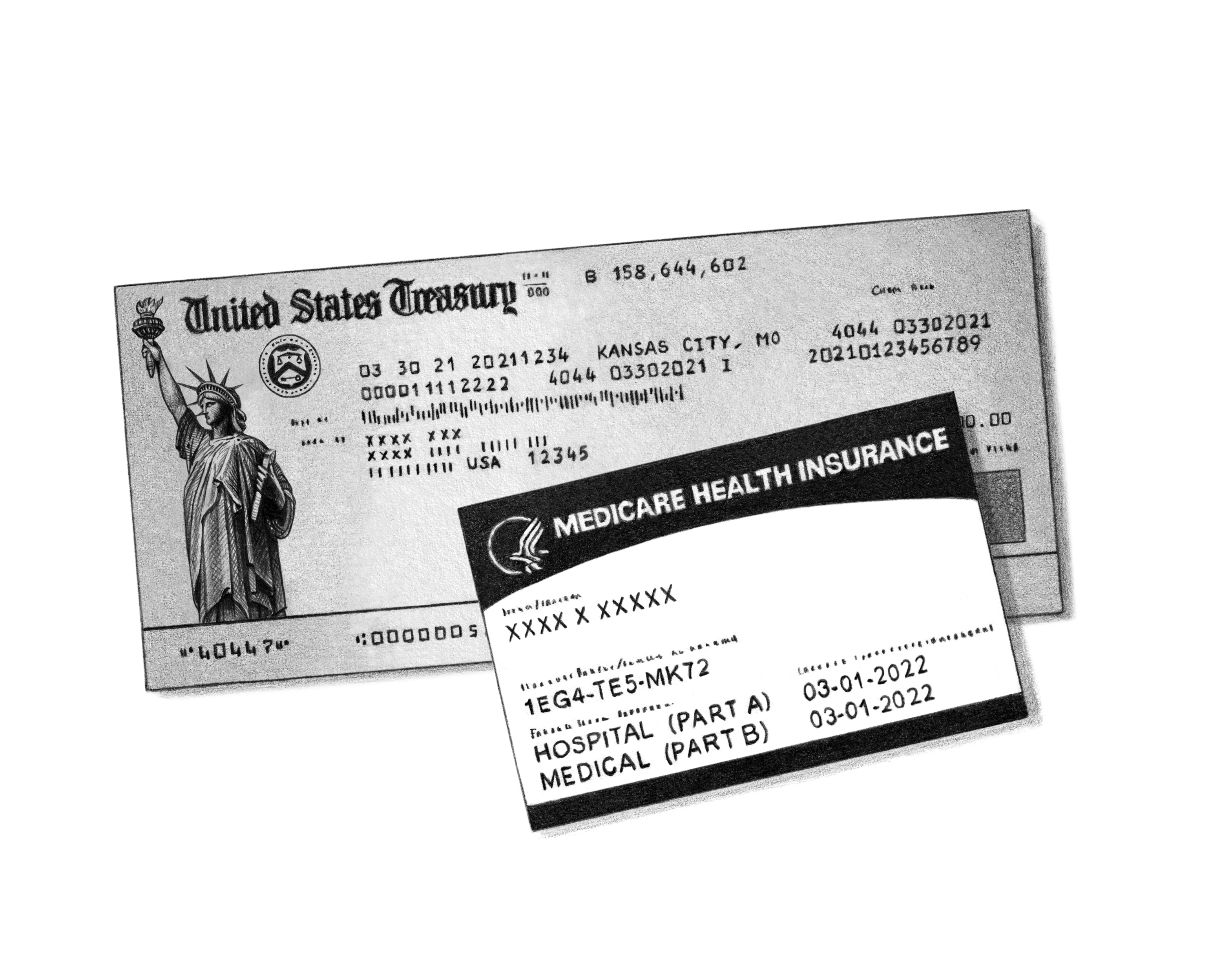

If you are unable to work because of a medical condition, there’s a good chance you qualify for benefits through Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). Millions of Americans with disabilities get benefits from these programs administered by the Social Security Administration. Monthly payments and free health insurance from the U.S. government can be lifesaving for you and your family. Learn all about the available programs, qualifications, and application processes below. We’ll help you figure out which program is right for you.

What are Social Security disability benefits?

The Social Security Administration (SSA) oversees two programs that provide benefits to people with disabilities: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). These government programs support Americans who are unable to work due to a qualifying medical condition. When someone says they’re “on disability,” they usually mean they are getting benefits from one of these programs. Together these programs are huge: About 20 million Americans receive some form of disability benefits administered by the Social Security Administration. SSDI and SSI both provide monthly benefits checks and health care coverage, but the eligibility requirements, qualifications, and benefits amounts differ.

SSDI qualifications

To qualify for Social Security Disability Insurance benefits, you must meet the medical and non-medical requirements:

You must be disabled under government rules. The SSA considers you disabled if you cannot hold a job for at least a year because of a medical condition in the SSA Blue Book. To prove you meet this requirement, your medical records must include specialist treatment.

You must have worked and paid taxes for years. Generally, you need 40 work credits to be eligible for benefits. Here’s a good rule of thumb: If you’ve worked at least five of the last ten years and paid taxes, you probably meet this qualification.

SSI qualifications

The eligibility requirements for the Supplemental Security Income include the following:

You must meet the SSA’s definition of disabled. The government has a specific definition of disability. To be eligible for benefits, you must not be able to sustain employment for at least a year because of an impairment or medical condition.

You must have very few assets. If you have less than $2,000 (or $3,000 if you are married), you probably qualify. You should count any money you have and other large assets, like a retirement account. Your home, one vehicle, and a few other unusual assets do not count.

You have very little income from any source. Every dollar you or your spouse make in income will decrease the amount you will receive from SSI. The government counts almost anything as income, including help you may be getting that’s not in cash, like if you live with friends rent-free. As a general rule, if you don’t have much cash coming in, and you aren’t getting a huge amount of help from others, you’ll probably qualify.

Qualifying for either program is never easy: The government treats claims with suspicion and rejects most applicants. But if you meet the criteria above, you can likely get benefits with the right help.

SSDI vs. SSI benefits: what are the differences?

SSDI and SSI both offer monthly checks and health insurance coverage, but there are key differences. In short, SSDI eligibility has work requirements and SSI is a needs-based program. Other differences include:

SSDI | SSI | |

|---|---|---|

Eligibility criteria | The SSDI program is for people with disabilities who have worked most of their lives and paid FICA taxes. | SSI is needs-based and offers benefits to people 65 and older with limited income and resources. |

Medical eligibility | If you cannot hold a job for at least a year because of a health issue, the SSA considers you disabled. | An impairment or medical condition must keep you out of work for at least a year to be eligible for benefits. |

Work credits | Your work history will determine your eligibility. Typically, eligibility for benefits requires 40 work credits. | Works credits are not a factor for SSI eligibility.

|

Application process | The application process will include information about your earnings history and medical conditions. | The application for SSI will require information about your medical conditions, assets, resources, and living arrangements. |

Payment amounts | SSDI monthly benefits amount depends on your lifetime earnings and how much you paid in Social Security taxes. | Your income and assets determine SSI payments. |

Health care coverage | SSDI beneficiaries can receive Medicare coverage. Medicare coverage begins 29 months after the date the government determines you became disabled. | SSI beneficiaries can receive Medicaid coverage. In some states, low-income individuals can receive Medicaid without being disabled. |

Additional benefits | You may get increased Social Security retirement payouts because the government won't count against the years not worked (as it would under normal circumstances). SSDI recipients might also receive vocational rehabilitation services. | SSI recipients may be eligible for other services, like the Supplemental Nutrition Assistance Program and housing assistance. |

Waiting period | There is a five-month waiting period for SSDI benefits. | You will start receiving your SSI benefits upon approval. |

How much does Social Security disability pay in 2024?

Every year, inflation and cost-of-living adjustments increase the value of Social Security benefits. The maximum payments amounts are as follows:

Social Security Disability Insurance: In 2024, the maximum amount you can earn from the SSDI program is $3,822 per month.

Supplemental Security Income: The maximum SSI payment for 2024 is $943 per month for an individual and $1,415 per month for a couple.

It’s important to note that disability payments might offset other benefits, but only if you get more from Social Security. For example, if you are getting $200 in food stamps, and you are awarded $1,000 in disability benefits, you may lose your food stamps. But you won’t end up with less money each month.

Estimate your disability benefit amount in just a few steps

We'll use the Social Security Administration's formula to estimate your monthly benefit.

Average

monthly check

$1,489

Should I apply for Social Security benefits?

If you are eligible for SSDI or SSI, or both, you should apply. There is no cost to submit an application. Apply as soon as it is clear that your condition is going to last a full year and you have the evidence to prove it.

Sometimes, that takes a while to figure out: your doctor may need to run tests and try a variety of treatments before they know how long your condition will last. Other times it is clear right away that a disability is long-lasting. Once your doctor is pretty sure your condition is going to keep you out of work for a full year, there is no reason to wait.

Can I get both SSDI and SSI benefits?

Yes, you can qualify for both SSDI and SSI benefits. If you are eligible for both programs you should apply for both. There are two advantages:

You might get more in monthly payments.

There are waiting periods for SSDI but not for SSI. If you are awarded benefits right away, you may still have to wait for your first check from SSDI. If that happens, getting a check for SSI in the meantime can be a lifesaver.

How does the application process work?

The disability application process takes time and effort, so it’s important to understand the steps. There are two major stages in the process, and most people go through both:

Submit an initial application: You submit a lengthy written application, details on past work and treatment, and copies of your medical records online or at your local Social Security office. A government staffer reads your file and makes a decision. (Only 20% of people win at this stage — the large majority are denied.)

File an appeal: If you lose, you appeal your denial and eventually get a hearing with a judge. At the disability hearing, you get to submit additional evidence, speak to the judge directly, and cross-examine government experts. (Among people who make it to this stage, about 50% win. If you lose, there are several more stages of appeal.)

The government fears that people will exaggerate their medical problems to get free money. To win, you have to prove — beyond a doubt — that your medical condition is severe and disabling through your application.

How long does the application process take?

After submitting an application, it can take 3-6 months to get an initial decision, and 1-2 years (or more) to get a disability hearing. Even a small mistake or omission (like a doctor failing to send in records, or a bad answer on a form) can doom an application.

The good news is that once you win — even if it takes a long time and several appeals — you get back pay or retroactive benefits for the time you should have been getting benefits.

Do I need a lawyer to apply for disability?

The most successful applicants get a lawyer or trained non-lawyer representative to help with the disability application process. Applicants who work with a lawyer are three times more likely to qualify for disability benefits. Lawyers will gather your medical records, write your application, advise you on getting proper medical treatment, submit all the paperwork, and, if needed, argue your case before a judge. There are some cases in which you might consider applying on your own:

Your medical condition is severe. If you’re seeing a specialist often, have extreme limitations and haven’t worked in years, you can likely win benefits on your own. You can automatically qualify for disability if your severe or terminal medical condition is on the Compassionate Allowance List.

You can’t convince a lawyer to take your case. If your case is quite hard to win, it can be difficult to find a lawyer. (Though we recommend trying our service before you give up!) In this case, you can apply on your own, and then try again to find a lawyer once you’ve been denied once — at which point it’s often easier to get representation.

Get help with your disability application

To determine your eligibility, take our brief quiz. A member of our legal team will connect with you for more information about your case, and we can match you with a qualified lawyer.

There are no upfront costs if you work with a disability lawyer. If they win your case, they get 25% of any back pay they win for you. This is worth it for almost everyone — you only pay if you win (if you lose, you pay nothing). You only pay once, and the cost pales in comparison to the amount you get.

Find disability help in your state

Jackie Jakab

Lead Attorney

For Clients

Fields of Law

For Lawyers

At the bottom of many websites, you'll find a small disclaimer: "We are not a law firm and are not qualified to give legal advice." If you see this, run the other way. These people can't help you: they're prohibited by law from giving meaningful advice, recommending specific lawyers, or even telling you whether you need a lawyer at all.

There’s no disclaimer here: Atticus is a law firm, and we are qualified to give legal advice. We can answer your most pressing questions, make clear recommendations, and search far and wide to find the right lawyer for you.

Two important things to note: If we give you legal advice, it will be through a lawyer on our staff communicating with you directly. (Don't make important decisions about your case based solely on this or any other website.) And if we take you on as a client, it will be through a document you sign. (No attorney-client relationship arises from using this site or calling us.)

- © 2025 Atticus Law, P.C.

Terms | Privacy | California Privacy | CHD Policy | Disclaimer | This website is lawyer advertising.