Everything You Should Know About Disability Benefits (SSDI and SSI)

Atticus offers free, high-quality disability advice for Americans who can't work. Our team of Stanford and Harvard-trained lawyers has a combined 15+ years of legal experience and has helped over 50,000 Americans apply for disability benefits.

If you’re too sick or injured to work, disability benefits can be life-changing. They provide monthly payments and free health care — keeping you on top of your health, and ahead of your bills.

But the process can be long and complicated. Many people aren’t sure where to start.

In this complete guide, we’ve compiled nearly all the knowledge we’ve published on navigating the disability benefits process.

We will provide an overview of the programs available, how to know if you qualify, how to apply, what happens after you submit your application, and what to do if you get rejected.

In each section, we’ve provided plenty of links to even more detailed, complete information. Whatever you’re going through, we’re by your side. Let’s get started!

What benefits are available for a disabled person?

There are multiple different ways Americans can access disability benefits. We’ll start with an overview of all the major programs, then go into the two most important: SSI and SSDI. The major programs are:

Social Security Disability Insurance (SSDI)

Supplemental Security Income (SSI)

State disability insurance (short-term disability)

Private disability insurance (short-term or long-term disability)

Workers’ compensation

Get more information about benefits programs in our article: Which Disability Benefits Do I Qualify For?

Social Security Disability Insurance (SSDI)

The basic idea behind SSDI: If you’ve worked recently, but are now too sick or injured to work, you can access the equivalent of your retirement benefits early.

Who gets SSDI?

SSDI is designed for people who were working for most of their adult lives, stopped due to disability, and won’t be able to work again for at least a year.

There are two basic requirements:

You’re unable to work (or at least unable to work much) due to a serious medical condition for at least a year;

Before you became disabled, you worked (and paid social security taxes) for much of your adult life, including (if you’re 31 or older) five of the last ten years.

What are the benefits?

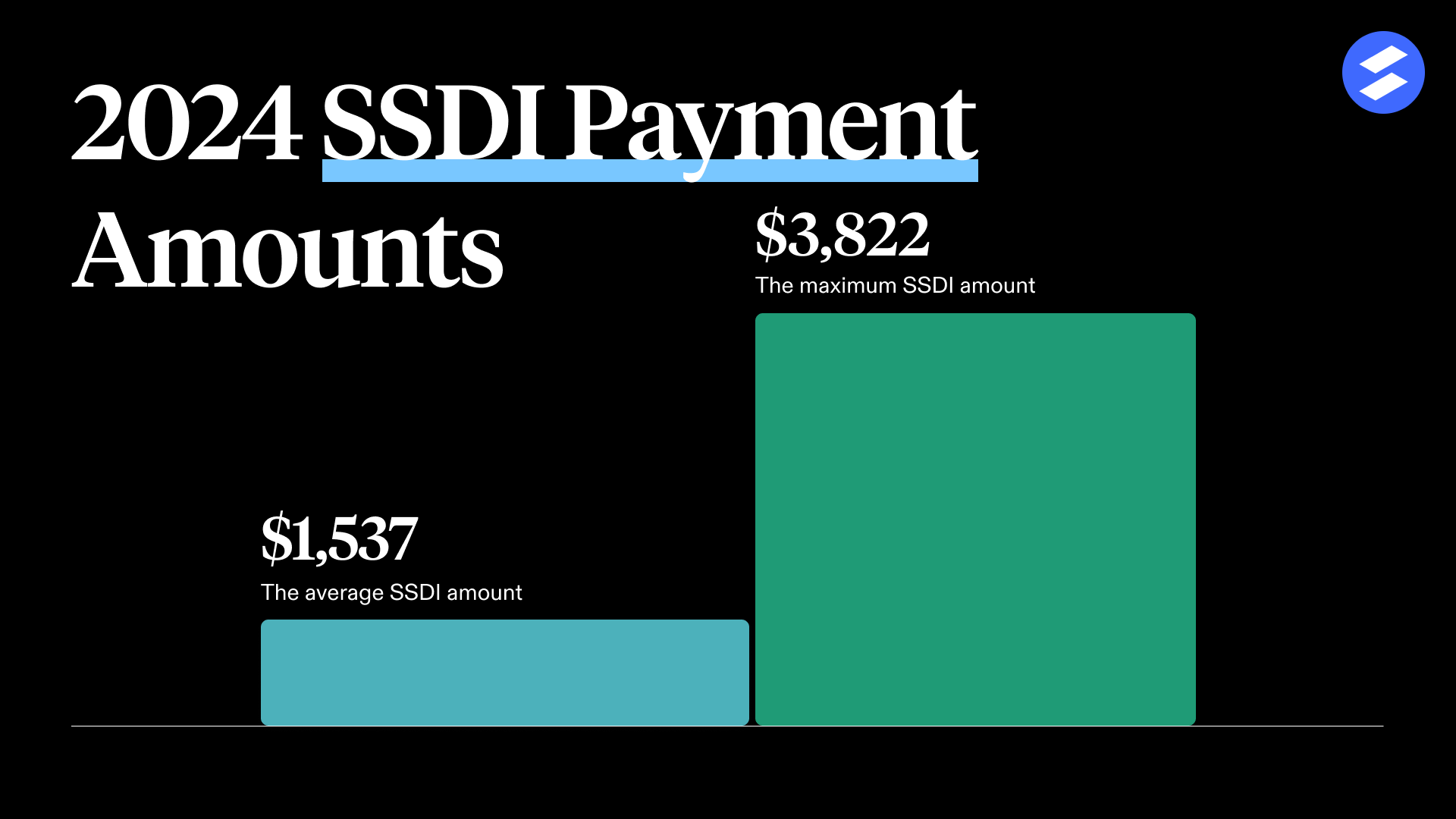

The average check size is around $1,500 per month, but it can be as much as $3,822 in 2024. After a two-year waiting period, SSDI recipients also get health insurance through Medicare. Benefits last as long as you’re disabled — sometimes for decades.

Estimate your disability benefit amount in just a few steps

We'll use the Social Security Administration's formula to estimate your monthly benefit.

Average

monthly check

$1,489

Supplemental Security Income (SSI)

SSI is for people with little to no work history, who wouldn’t qualify for SSDI. Payments are based on your financial need, not your work history.

Who gets SSI?

There are two main criteria to qualify for SSI:

You’re unable to work (or at least unable to work much) due to a serious medical condition for at least a year;

You have little or no income, and little or no money in the bank.

What are the benefits?

The maximum benefit is $943 per month in 2024, although residents of some states get a bit more — up to $200 extra. People who receive money from other sources get less because the government deducts other income from your SSI check. Recipients get Medicaid immediately once they qualify.

State disability insurance

Five states (California, Hawaii, New Jersey, New York, and Rhode Island) offer short-term disability and provide a percentage of your old salary for 6 to 12 months if you become disabled.

Who qualifies for state disability insurance?

You qualify for SDI if you live in a state with short-term disability, and can no longer do your last job due to a documented medical problem or injury.

The five basic requirements are the same in all five states:

You live in one of five states that offer SDI or an equivalent: California, Hawaii, New Jersey, New York, or Rhode Island;

You’ve worked some amount in the past year (requirements vary);

Your doctor is willing to certify you as disabled on a state form;

You’re not also receiving Workers’ Compensation — i.e. you’re probably not disabled due to something that happened at work.

What are the benefits?

Recipients get a weekly or monthly check, usually 50-66% (or less) of their previous wages from work. Each state pays a different amount. California pays benefits for up to a year, but every other state pays for only six or seven months.

Private disability insurance (short-term or long-term)

If you bought private disability insurance, or received it through your employer, you may file for payments from your insurer under the policy’s terms.

Who qualifies for private disability insurance?

To qualify, you must have bought private insurance before you became disabled.

Most people with private disability insurance get it through their employer. Some employers even provide it for free.

What are the benefits?

Short-term policies usually pay 80% of your past earnings for 3-6 months. Long-term policies usually pay 50-60% of your past earnings for many years (usually until you retire).

The exact terms will depend on the unique policy you bought.

Workers’ compensation claims

Were you injured at work? Get monthly payments and medical coverage from your employer until you get better (as required by state law).

Who qualifies for workers’ compensation?

If you were injured at work, or as a result of your work, you can usually make a claim for workers’ compensation payments.

Most (but not all) employers in the U.S. must maintain workers’ comp insurance.

What are the benefits?

Workers’ compensation pays your medical bills, and also provides a monthly payment to replace part of your lost wages.

Most plans pay up to 80% of your pre-injury wages. In many states, insurance companies send you to doctors they (not you) pick to determine what treatment is necessary, and what work limitations you might have.

Remember, this information is just an overview. Get more detailed information about benefits programs in our article Which Disability Benefits Do I Qualify For?

Supplemental Security Income and Social Security Disability Insurance

These are the two programs that most Americans with disabilities will access, so they’re the ones we’ll focus on in this guide.

As mentioned, SSDI is a form of employment insurance provided by the federal government. If you've worked most of your life and develop a medical condition that makes it impossible to continue — you can retire due to disability rather than age.

If you qualify for Social Security Disability you will get two big benefits:

A monthly check (usually for between $1,000 and $3,000);

Free health insurance through Medicare (sometimes after a waiting period);

You can also get other benefits, including extra money if you care for young kids, forgiveness of student loan debt, and an easier time qualifying for other government programs.There’s no downside to receiving benefits, and it’s free to apply.

In general, you’ll need to meet six criteria to qualify for SSDI:

You’re under 66 years old;

You’re getting treatment for a serious medical condition;

Because of your medical condition, you can’t realistically hold a job;

You’re not currently working (or if you are, it’s part-time and very low-paid);

You’re not expected to recover (or be able to work) within a year;

Before getting sick, you worked and paid taxes for at least five of the last ten years.

Applying for SSDI is free and, if you’re approved, you can keep your health insurance, or access Medicare. Apply as soon as you can — immediately after it becomes apparent that your disability will stop you from working for at least one year.

Get more details on SSDI and how to apply here.

Think of SSI as a counterpart for SSDI, but for those without much work history and who have little or no income or assets.. It’s there to act as a safety net for people that haven’t paid into SSDI.

If you qualify for Supplemental Security Income you will get two big benefits:

A monthly check (up to $943 for one person, or $1,415 for a married couple);

Free health insurance through Medicaid.

In order to qualify for SSI, five things usually have to be true:

You’re getting treatment for a serious medical condition;

Because of your medical condition, you can’t realistically hold a job;

You’re not currently working (or if you are, it’s part-time and very low-paid);

You’re not expected to recover (or be able to work) within a year;

You have less than $2,000 in assets if you are single ($3,000 if you are married), and you (or your spouse) don’t have any other significant income.

Get more details on SSI and how to apply here.

How do I know if I qualify for disability benefits?

Now, you’ve got a basic overview of the types of benefits that most Americans have access to.

We’ve gone over the two major programs in greater detail — SSDI and SSI.

But qualifying for disability can be a lot more complex than meeting the basic criteria. What conditions are considered a disability? Can you get a sense of whether you’ll be approved before you take the time to apply, and maybe hire a lawyer? What happens if you’re already getting retirement benefits, or are planning to get them soon?

Let’s dig into these important questions in greater detail.

What conditions qualify for disability?

Many conditions, mental and physical, can qualify for Social Security disability, as long as they’re severe enough to keep you from working. Some conditions, such as terminal illnesses (TERI) conditions and compassionate allowance conditions (CAL) may even automatically qualify you.

In general, if your condition makes it very hard or impossible to work over an extended period of time, it’s worthwhile to apply for disability — even if it is not on the compassionate allowance list.

Conditions that can qualify for disability benefits

The SSA maintains its own full “listing of impairments” in its BlueBook. But here, we’ll share a few of the most common conditions that qualify for disability benefits.

This is not an exhaustive list, and there are many different conditions that may qualify you for disability benefits. Get more information on these conditions, and how the SSA determines your eligibility in our article What Conditions Qualify For Disability?

Mental illnesses, like anxiety, depression, bipolar disorder, developmental disorders, and PTSD;

Musculoskeletal or orthopedic conditions like back pain, and rheumatoid arthritis;

Sense and speech disorders like blindness and deafness;

The rules here can be very complicated and technical. We recommend looking at the SSA guide to sensory disorders and bringing them to your doctor.

Respiratory conditions like COPD, cystic fibrosis, asthma, emphysema;

Cardiovascular system conditions like congestive heart failure, aneurysms, and coronary artery disease;

Digestive system disorders like Crohn’s disease, chronic hepatitis, and inflammatory bowel disease;

Hematological (blood) disorders, like aplastic anemia, disorders of bone marrow failure, and sickle cell disease;

Skin disorders, like bullous diseases, dermatitis, and burns;

Endocrine disorders, most commonly diabetes;

Certain types of cancers, including most stage 4 diagnosis, should qualify someone for disability benefits automatically assuming they meet the technical requirements.

Immune disorders, like lupus, gout, and HIV/AIDS;

Neurological disorders, like epilepsy, stroke, cerebral palsy, multiple sclerosis, and ALS.

Again, find more complete information on these conditions in our article What Conditions Qualify For Disability?

Conditions that automatically qualify you for disability

There are two categories of conditions that automatically qualify you for disability benefits — compassionate allowance cases, and TERI (terminal illness) cases.

Compassionate allowance conditions are those that are deemed sufficiently disabling by diagnosis alone. There are many disorders on this list — like Coffin-Lowry syndrome, early-onset Alzheimer's, and several types of cancer. We’ve listed all the compassionate allowance conditions here.

Terminal illness, or TERI conditions, sometimes overlap with these.

Here are some, but not all, of the conditions or treatments designated TERI:

AIDS (acquired immunodeficiency syndrome);

Amyotrophic lateral sclerosis (ALS), known as Lou Gehrig's disease;

Receiving inpatient or at-home hospice care;

Chronic dependence on a cardiopulmonary life-sustaining device;

Chronic pulmonary or heart failure requiring continuous home oxygen;

Any cancer that is metastatic (has spread), Stage IV, persistent and recurrent following initial therapy, or inoperable;

Cancer of the esophagus, liver, pancreas, gallbladder, mesothelioma, small/oat cell lung cancer, brain cancer, acute myelogenous leukemia (AML), or acute lymphocytic leukemia (ALL);

A coma lasting for 30 days or more;

Lethal genetic or congenital defects in newborns.

What are my odds of getting approved?

Even if your condition is included in the list of CAL and TERI conditions, you still might be unsure if the SSA will consider it a true disability.

But, generally, which specific disability you’re living with isn’t the important question; what matters is that you can prove your condition doesn’t allow you to work, and those effects will last for at least one year.

It’s totally possible that if you’re unable to work, you could get benefits — in theory, even if the SSA has never awarded benefits to someone with your condition before!

Disability benefits after age 50

There’s one particular factor that might make you more likely to be approved for disability benefits: being in your fifties.

If you are under 50, when evaluating whether or not you can work, the Social Security Administration evaluates whether or not you can work any job.

For example, suppose you worked in construction before becoming disabled. In that case, you’d have to prove you can no longer work in construction and that you can no longer work in any field (at a desk, taking tickets at a movie theater, washing dishes, etc.).

But if you’re over age 50, the SSA may consider you less “trainable” in new skills, and more vulnerable to injury and illness. You would likely just need to prove you couldn’t work your old job, not that you can’t do any kind of work at all. In the example above, you would need to prove you could no longer do construction work, not any work.

However, being over 50 doesn’t guarantee you an automatic approval. If you’re in your 50s, the SSA will still assess:

If you are able to work in any capacity in your previous workplace;

If you are able to learn new skills;

If you are able to work in a new work environment;

Your current capacity for basic physical activities.

Get more information about disability benefits when you’re over 50 here.

What other benefits can I get with SSDI and SSI?

Of course, disability benefits aren’t the only kind of social safety net available to Americans. If you qualify for retirement or unemployment benefits, how does that change the picture?

Disability and early retirement benefits

It’s normally much easier to get retirement benefits than disability benefits. If you’re relatively close to retiring, it might seem like the path of least resistance to just retire early.

However, if you retire early, you’ll get a “penalty” — which means you’ll receive a lower monthly payout throughout the rest of your life. When you are approved for SSDI, you are not penalized the same way — you get your full retirement once you’re approved, and throughout the rest of your life.

In most cases, you’ll also get “back pay” — retroactive payments that “make up” for what you would’ve received while your application was pending.

In short: If you can afford to wait for disability benefits, you’ll receive more money in the long run than you would have with early retirement.

Get more information in this article about whether receiving disability will affect retirement benefits.

Disability and unemployment benefits

If you can’t work because of your disability, but you haven’t yet received a decision, unemployment benefits might seem like the perfect stop-gap option.

But unfortunately, collecting or applying for both of these benefits at the same time isn’t recommended. Being part of one program may disqualify you from the other.

Unemployment benefits are intended for people who can work, and are just looking for a new opportunity. Disability benefits are for those who are unable to do any kind of work at all.

However, there are exceptions. The programs can also work well consecutively. For example, by going on unemployment, then applying for disability when it becomes clear you can’t go back to any job.

Get more information in our article, Can You Get Unemployment and Disability At The Same Time?

How do I apply for disability benefits?

Even if you’re confident that you qualify for disability benefits, applying is a fairly long and complex process. In many cases, you’ll be rejected at first and need to appeal — maybe even multiple times.

Here are the nuts and bolts of the Social Security disability application process.

Before you apply for disability benefits

Remember, qualifying for disability isn’t just about having a certain diagnosis (though that certainly matters).

It’s about proving that your condition makes you completely unable to work.

For that reason, you should compile plenty of evidence proving your history with your medical condition and how it holds you back before you even start compiling your application.

That’s why, while your doctor can’t put you on disability independently, you do need to be working with a doctor for your application to be approved. The SSA cannot approve benefits applications unless they also get your medical records.

To provide the best proof possible of your condition, consider:

When talking to any doctor, always describe your symptoms at their worst;

Get a formal diagnosis and ensure your condition is being actively treated;

See your general practitioner regularly, making sure they note down your symptoms in your medical file;

See specialist doctors, who are experts in your condition;

If you can, stop working to make a stronger case that your condition renders you unable to work.

By building strong relationships with medical professionals, and making sure your condition is being well-documented, you’re laying the groundwork for a disability benefits application that will be approved.

Get more information on how to talk to your doctor about applying for disability benefits here.

How long will it take to get a decision?

Getting approved for disability benefits is a lengthy process. Be prepared to wait for 2-2.5 years to get a final decision.

But, often you are entitled to back pay for the time you were waiting on a decision. You’ll get that payment in your first check.

That process includes a few stages:

Initial application and evaluation

Processing time is generally 7-8 months from when you submit your application.

In this time, the SSA may ask for supplemental material and information, like more paperwork or a consultative exam.

Reconsideration and hearing

Processing time is usually 1.5 to 2 years after your initial denial (around 80% of applicants will be rejected at first).

After your initial denial, you can request a reconsideration and set up appeals and hearings. This is a normal part of the process for most applicants.

You may also be asked for more information or a consultative exam at this stage.

For more detailed information on how long you’ll wait, see our article How Long Does It Take to Get Approved for Disability Benefits?

Let’s start by covering that initial application. Then, we’ll talk about what happens after you apply — whether you’re approved (yay!), or you get a denial and need to appeal.

The initial disability application

To apply for disability, you’ll fill out one major application form, Form SSA-16, and multiple supplementary forms that you fill out as needed. The most important of these supplementary forms are Form SSA-3373 (Function Report), and Form SSA-3369 (Work History Report).

To improve your chances of success, there are a few basic principles to follow as you complete each of these forms.

Be honest and concise. Don’t over-explain — just answer the questions in simple, specific terms. Be careful not to exaggerate, and be mindful of what may look like exaggeration.

Be consistent. The SSA will look carefully to make sure your condition and abilities are described the same way throughout your application. Ensure that how you describe your abilities lines up with the actual daily tasks you describe.

Don’t tell your life story. The SSA’s job isn’t to evaluate the hardship your disability has caused you personally or the strength you’ve shown in overcoming it. They are only looking for evidence that you are unable to work.

Form SSA-16

Filling out Form SSA-16 is the first step in your application. It will ask you for basic information like:

Contact details;

Demographic information;

Income;

Marital status;

Your family and caregiving responsibilities;

If you’re receiving any other benefits.

You will also need to share the overall timeline of your disability. When was the initial onset? When did it start to prevent you from working?

Get complete directions on Form SSA-16 here.

Form SSA-3373: Function Report

The Function Report gives the SSA a more complete picture of your abilities, and how much your disability holds you back from functioning normally.

This is a 10-page form that asks about your daily activities and how your health conditions affect your ability to work or go through life.

The Function Report is one of the most important forms in your disability application. The SSA will also compare your answers on this function report with your answers on other forms to make sure they appear consistent and honest.

The Function Report includes questions about:

Your living situation;

Your illnesses, injuries, or conditions;

How those illnesses, injuries, or conditions hold you back;

Your daily routines and activities;

Caregiving responsibilities.

Get complete directions on Form SSA-3373 in our guide here.

Form SSA-3369: Work History Report

The Work History Report tells the SSA what kind of work you’ve done in the past, both immediately before you became disabled and throughout your work history.

This form paints a comprehensive picture of the work activities you’ve been able to do in the past, and what transferable skills you may have for other jobs.

The Work History report includes questions about:

A list of all your previous jobs;

Duties you performed in your last six jobs;

Physical tasks, like the heaviest weight you lifted;

Whether you supervised others.

Get complete directions on Form SSA-3369 here.

What happens after you apply for disability?

Submitting that application is just the first step of the process. After you submit your application, your local Disability Determination Services (DDS) office will assess your medical eligibility, and the SSA will assess your technical eligibility for benefits.

As we mentioned, they’ll usually make an initial decision within 7-8 months. How you move forward will depend on whether you were approved or denied.

What if I get rejected?

As we mentioned, around 80% of applicants do get rejected at first. So it’s critical not to panic — you have plenty of resources, and multiple chances to change the decision. In fact, almost half of applicants will be approved at the hearing stage!

If your SSDI claim isn’t approved, you’ll find out through a denial letter from the SSA. The most important information in this letter is why you were rejected: it may be for medical or non-medical reasons.

In either case, you have the right to appeal the decision and move forward anyway. Get more information about denial letters in our article SSDI Denial Letters: Understanding “Why” and Deciding What's Next.

If I’m rejected, do I need to apply again?

While you certainly can apply for disability as many times as you like, you won’t want to — it’s an arduous process, and doing so wouldn’t improve your chances of success.

If nothing about your application has changed, it’s unreasonable to expect that applying again would result in a different decision.

Instead, you should extend your first application by requesting reconsideration or scheduling hearings to appeal the SSA’s decision. You should only submit a new application instead of appealing your current application in certain specific cases, such as if you missed the time window for requesting a hearing without a good reason.

Get more information in our article about how many times you can apply for disability

Should I appeal? Is it worth my time?

The short answer is yes. Hearing and appeals are a normal part of the disability application process!

Remember, around 80% of applications will be denied at first.

If you request reconsideration after receiving an initial denial, the SSA will look again at your existing application. However, just around 10% of applicants will be approved at this stage.

If you get a denial during the reconsideration phase, you should request a hearing.

More than half of applicants at the hearing stage will be approved!

Working with a disability lawyer is one of the best ways to improve your chances of success. Being represented by a lawyer will not drag out your case or make it more complicated; on the contrary, you are three times more likely to win at a hearing if you have legal representation.

Get more information on why you should work with a lawyer in our article Your Chances of Winning a Social Security Disability Appeal.

The disability hearing

The hearing is your best chance to change the SSA’s decision and get access to disability benefits.

Disability hearings are private and confidential proceedings. They typically take place over the phone and last approximately one hour.

After you request a hearing, the SSA will decide on a date and issue you a hearing notice letting you know who will be there.

Typically, that includes:

The judge;

You (the claimant);

Your legal representative if you have one;

A vocational expert (hired by the government);

A hearing reporter.

During the hearing, the judge will review your past relevant work experience, consult with the vocational expert on the types of jobs available for someone with your functionality, and ask you questions.

After the hearing, the judge assesses your responses and decides on your case. This decision can take anywhere from a few weeks to a few months.

Get more detailed information about hearings in our article: What to Expect at a Disability Hearing.

The judge will ask the vocational expert questions about the jobs the government acknowledges are available and the skills required to perform those jobs.

The judge will often ask questions to the vocational expert in a hypothetical format. For example, they might say “Hypothetically, what kind of work could someone perform, who has XYZ condition and X number of years of experience?”

If you have a lawyer, they’ll cross-examine the vocational expert with their own questions, too. This is part of why it’s so important to have legal representation at the hearing stage.

For more information on vocational experts, see our article: Who Is the Vocational Expert at a Hearing?

The judge will ask the claimant (you) detailed questions, as well. Expect the judge to ask you questions about:

Your work history and what you did at your past jobs;

Open-ended questions about your abilities and condition;

Specific, pain- and ability-related questions;

Questions about your daily functioning.

It’s crucial to be well-prepared for these questions because it’s easy to accidentally contradict yourself and hurt your case. Learn how to avoid common mistakes in our article: How to Prepare for a Judge's "Trick Questions" at a Disability Hearing.

Consultative exams

If they need more information about your disability, the SSA might request that you take a consultative exam.

This is just an appointment with a doctor hired by the SSA to gather more information about your condition. The SSA covers the cost of your consultative exam, including significant travel costs.

The main purpose of a consultative exam is to determine whether your health condition meets the SSA’s definition of disability. So the exact nature of your experience and what kind of doctor you see will depend on your situation. They’re usually short — about 20 minutes or less.

The SSA may ask for a consultative exam if:

Your health records don’t clearly show that a professional diagnosed you with the condition you say you have;

DDS needs more detailed information about the severity of your impairment;

There are inconsistencies in your medical history, like conflicting results from your doctors;

The information in your benefits application doesn’t clearly show that your condition keeps you from working;

Certain technical or specialized requirements aren’t addressed in your medical records, so DDS can't prove your condition meets the SSA definition of disability.

Get more information in our article on what happens after you see a disability doctor.

Is a consultative exam a good or bad sign?

Many people find these exams nerve-wracking. But they’re nothing to worry about — you just need to approach them in the right way.

Think of consultative exams as a formality. They’re the SSA doing due diligence, not your chance to prove you’re disabled, or gather your own medical information.

Because the SSA’s doctor is new to you, they don’t know your background and condition as well as your own doctors. These exams do not replace exams and information you’ve already gathered from your own doctor and specialists.

In general, follow the same guidelines at your consultative exam that you would any time you’re speaking to a doctor about your disability.

Here are some tips:

Be very specific when describing your symptoms and how they prevent you from working;

Answer questions by describing your condition on an average, or worse than average day, not the actual day of the exam;

The exam is your time to complain! The doctor only needs to hear about your struggles, not the ways you’ve overcome them or how you’re doing well.

If you’re concerned about your exam, schedule an appointment with your own doctor around the same time. That will make it much easier to dispute the results later, if you need to.

If you’re still nervous, you can learn more in our guide to consultative exams.

If I get approved, what happens next?

If you’ve been approved, you’re probably relieved and excited. You’re still living with a disability but, hopefully, financial stressors will be less of a concern from now on.

You probably still have plenty of questions. What’s life like on disability benefits? Can you still work? Will you pay taxes? And the big question — how much will you get paid?

Can I work on disability benefits?

Working on disability benefits (or while you’re waiting to get them) can be risky. If you’re working a lot or making plenty of money, SSA may doubt whether you need benefits at all.

But working part-time is still possible sometimes, as long you provide the right information to the SSA.

On SSDI, work considered “substantial or gainful activity” will disqualify you from receiving disability benefits.

Substantial means working the same or close to the same amount as you would be if you weren’t disabled.

Gainful describes how much money you are making. Are you making enough money to support yourself without social security benefits?

On SSI, you will be restricted by income and asset limits because these benefits are not determined by your work history.

In general, you must have less than $2,000 in resources and make less than $943 per month to receive SSI.

The rules around what counts as substantial or gainful are complex, as are what’s considered income and assets.

Before starting to work on disability benefits, get complete, detailed information in our article Working on Disability Insurance — Income and Asset Limits.

How much will I make on SSI and SSDI?

How much you’ll make on SSI, and SSDI, varies from person to person. How much you make on SSDI is determined by your work history, while your SSI payout is based on your current financial need.

Speaking generally:

The most you can get on SSI is $943 per month;

The most you can get on SSDI is $3,822 per month.

Which program you’re in, your work history, and your other income and assets will affect how much you get paid.

Find more information on how your payouts are calculated, what counts as income, and additional support you might get in our article SSDI and SSI Claims — Monthly Payment Amounts.

What about back pay?

Back pay comprises the benefits you were entitled to while your application was being processed.

You’ll get back pay as a lump sum on your first disability check.

How much back pay you’re entitled to depends on your benefits program, when the SSA determines you became disabled, and how long it took your application to be approved.

On SSI, you’re entitled to back pay from the date you applied for benefits (unless you weren’t yet disabled).

On SSDI, you’re entitled to back pay from the date you became disabled, up to one year.

These are the most important factors, but there are many more rules, regulations, and caveats to consider.

Get more information on what back pay is, how and when you might get it, and how it’s calculated in our article Social Security Disability Back Pay: How Much (and When) Do You Get Paid?

Do I pay taxes on disability benefits?

Typically, no. Only about one third of Social Security Disability benefits recipients pay some tax on their benefits.

The most common reason you’d be taxed is if your spouse's earnings change the household income. Passive income (like stock dividends) could also affect whether you pay tax.

How much you’ll pay in taxes depends on your income, whether you’re married, and which state you live in. Get complete information about tax on disability benefits in our article Where and When are SSDI Benefits Taxable?

Who can help me apply for disability benefits?

We know how overwhelming applying for disability benefits can be. You’re faced with a serious condition that makes you unable to work — and getting help can feel like a full-time job!

You don’t need to go through this alone.

If you need legal advice or representation, reach out to us at Atticus. We connect people in crisis with trustworthy, free, and fast advice from legitimate lawyers.

We are in your corner throughout your application process making sure you get the support you need. Remember, disability applicants with legal representation are three times more likely to be successful.

If you’re not there yet, that’s okay, too.

We’ve compiled this free resource guide for people with disabilities. It’s a list of some of the best resources — housing, medical care, food security, and legal aid — available to adults with disabilities in the US. If you’re applying for disability benefits, and are wondering what to do while you wait, these national and local programs are a great place to start.

Frequently asked questions about disability benefits

What do you get with disability benefits?

Disability benefits offer monthly checks and free or low-cost health insurance if you can’t work anymore because of a medical condition.There are two types of federal benefits. SSDI offers payments plus Medicare. SSI is an option for low-income individuals and includes Medicaid.

How much do disability benefits pay?

SSDI pays up to $3,822 per month in 2024, but the average SSDI check is about $1,500. Your exact check is based on your income and tax history. SSI pays up to $943 per month with your other monthly income subtracted from that maximum amount to find your benefit amount.

When should I apply for disability benefits?

We recommend you apply for benefits as soon as you know you’ll be unable to work. The application process can take a while — a year or longer for the average person. The sooner you submit your application, the sooner you can get benefits.

Do I need a lawyer to apply for disability benefits?

Not technically, but hiring one is worthwhile for most applicants. The SSA denies most initial applications and a lawyer increases your chances of winning an appeal. If you’re applying for state benefits or private disability benefits, you probably don’t need a lawyer.

Are there other types of disability benefits?

Beside Social Security disability, there are short-term disability benefits for people in a very small number of states. Injured workers can access workers’ comp and veterans can apply for VA disability. Anyone who already had a private disability insurance plan can also file a claim for those benefits. Learn more about the types of disability benefits.

Find disability help in your state

Sarah Aitchison

Attorney

For Clients

For Lawyers

At the bottom of many websites, you'll find a small disclaimer: "We are not a law firm and are not qualified to give legal advice." If you see this, run the other way. These people can't help you: they're prohibited by law from giving meaningful advice, recommending specific lawyers, or even telling you whether you need a lawyer at all.

There’s no disclaimer here: Atticus is a law firm, and we are qualified to give legal advice. We can answer your most pressing questions, make clear recommendations, and search far and wide to find the right lawyer for you.

Two important things to note: If we give you legal advice, it will be through a lawyer on our staff communicating with you directly. (Don't make important decisions about your case based solely on this or any other website.) And if we take you on as a client, it will be through a document you sign. (No attorney-client relationship arises from using this site or calling us.)

- © 2025 Atticus Law, P.C.

Terms | Privacy | California Privacy | CHD Policy | Disclaimer | This website is lawyer advertising.