What Is the Social Security Disability 5-Year Rule?

Atticus offers free, high-quality disability advice for Americans who can't work. Our team of Stanford and Harvard-trained lawyers has a combined 15+ years of legal experience and has helped over 50,000 Americans apply for disability benefits.

To qualify for Social Security Disability Insurance, you must meet medical and technical requirements. There are special rules and qualifications, and the Social Security five-year disability rule can help determine if you meet the work history requirements.

This informal rule helps indicate if you’ve worked at least five out of the past 10 years and earned enough Social Security Administration work credits to be eligible for SSDI disability. Learn more about this guideline and how to check your work credits for eligibility.

How to qualify for Social Security Disability Insurance

Social Security Disability Insurance (SSDI) is a form of financial assistance for people unable to work because of an impairment or medical condition.

To qualify for SSDI, you must be under 66 years of age (full retirement age) and receive treatment for a serious medical condition that keeps you out of work for at least a year. Work history is another key component to eligibility: You must have worked and paid Social Security taxes for at least five of the last 10 years.

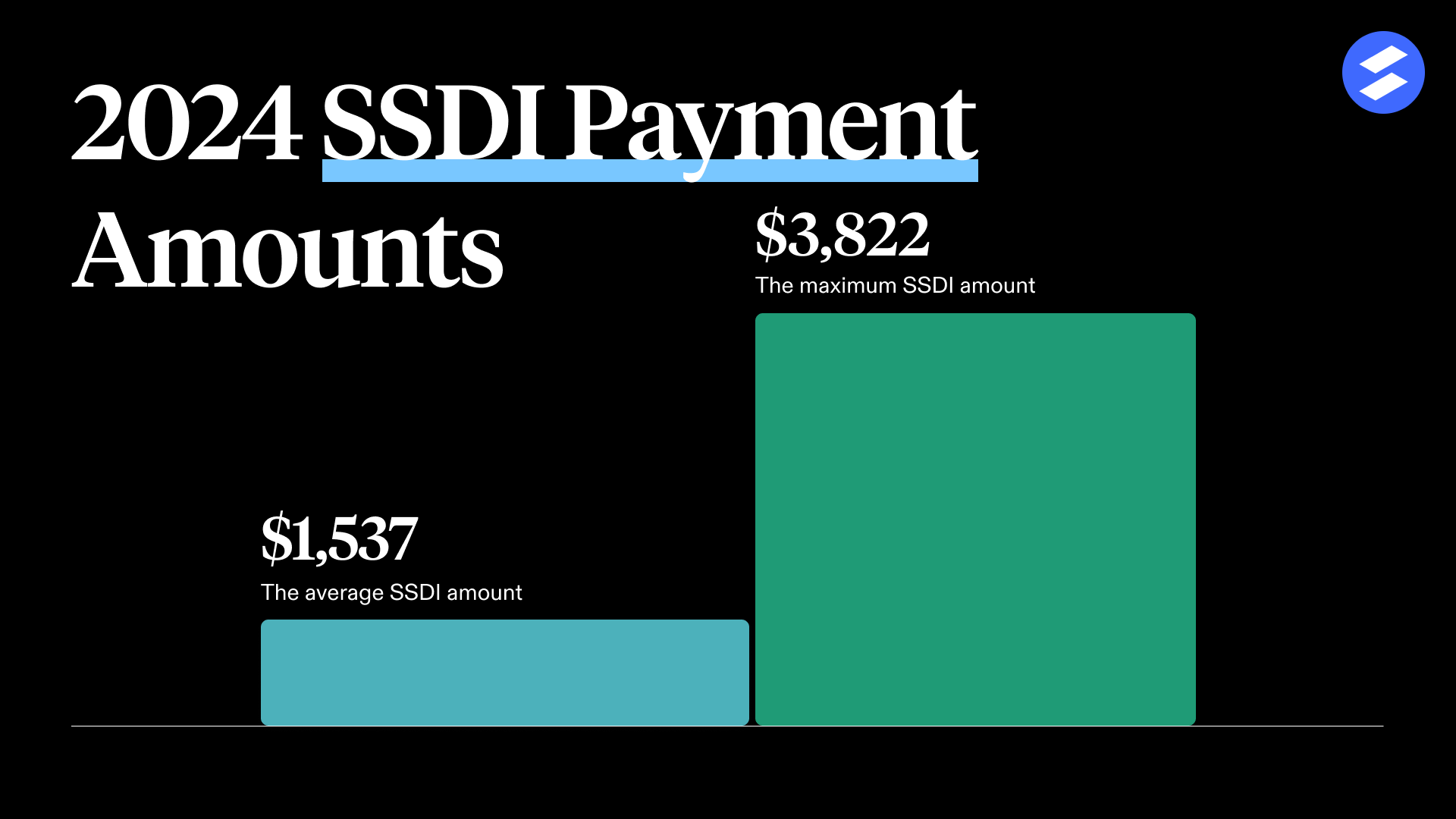

SSDI benefits include monthly cash benefits and Medicare health care coverage. The payment amounts are based on work history and earnings. In 2024, the maximum amount of SSDI benefit payments is $3,822 per month. Most people won't get that much, though — the average monthly benefit is about $1,537.

What is the 5-year rule for Social Security disability?

The Social Security disability five-year rule is an informal rule of thumb that assesses your work history. If you’ve worked at least five of the past 10 years, you will likely qualify for Social Security Disability Insurance (SSDI).

The "five-year rule" can also refer to the elimination of a waiting period for SSDI beneficiaries re-applying for benefits. Typically, there is a five-month waiting period for benefits after the SSA approves your application. If you received SSDI benefits in the last five years and discontinued them, and you require them again, you might be eligible to reinstate your benefits faster.

SSDI work credit requirements

Social Security Disability Insurance is an employment insurance program. By working and paying Social Security taxes on your earnings, you can access disability benefits if you are unable to work due to a medical condition.

To qualify for SSDI, you must have a certain number of work credits. The exact number of work credits you’ll need can vary by age, but most people must have at least 40, with 20 earned in the last 10 years.

Individuals accrue work credits based on work history and income, and you can earn a maximum of four work credits each year. For every $1,730 in your paycheck in 2024 — for either wages or self-employment income — you get one work credit.

It takes five years to earn 20 credits, but this doesn’t mean you have to work five full years or even five consecutive years. You can work partial years, part-time, or slowly earn those credits in any other way over the 10 years, so long as you meet the 20-credits-in-10-years requirement.

What is your date last insured?

Your date last insured, also known as DLI, refers to the date you last had enough credits for Social Security Disability Insurance. Remember, you must work five out of the last 10 years to qualify for SSDI. But if you are no longer actively working, the Social Security Administration will consider your DLI when determining eligibility.

You can calculate your DLI by adding five years to the last year you worked. For example, if you worked from 2009 to 2019, your DLI would be 2024, and the last year you’d be eligible for benefits.

Social Security eligibility for different employment categories

If you fall into any of the following employment categories, it’s helpful to double-check you are paying Social Security taxes and receiving work credits for your work:

Self-employed: If you are self-employed, you must declare your income and file self-employment taxes to earn work credits.

State employee: Some state employees need to opt-in to SSA taxes.

Nonprofit employee: If you work for a nonprofit organization, your company may not be required to pay federal taxes.

How to check how many work credits you have

If you’re unsure how many work credits you have, you can check online through a mySocialSecurity account. Follow these steps to log in to your account and find your credits:

Visit the SSA’s mySocialSecurity on www.ssa.gov

Create an account using your Social Security Number, or log in to your existing account

Scroll down to the section titled “Eligibility and Earnings” to check your accrued work credits

If you believe your work credits or income and tax history need to be corrected, contact the SSA or visit your local Social Security Administration office in person to update your information.

What if I don’t have enough work credits?

The Social Security Administration has two disability programs. If you do not meet the work history requirements for Social Security Disability Insurance (SSDI), you may be eligible for Supplemental Security Income (SSI).

The SSI program provides monthly benefits and Medicaid for people with disabilities and limited income. There are no work history requirements or work credits necessary to qualify for SSI. If you meet the SSA’s definition of disability and criteria for SSI, you can get up to $943 per month in benefits.

Learn more about the different eligibility requirements and benefits between SSDI and SSI here.

Get help applying for disability

If you have questions about your work history, work credits, and whether you qualify for SSDI based on the five-year rule, a disability lawyer can help. A lawyer can help you fill out your SSDI application and be on hand to vouch for you in court if your case goes to a hearing.

Fill out our 2-minute disability benefits quiz and a member of our team will be in touch to learn more about your case. If you’re interested, we can connect you with a lawyer to help you navigate the disability benefits application process.

Related resources:

Everything You Should Know About Disability Benefits (SSDI and SSI)

An Easy-to-Follow Guide to Applying for Disability Benefits

Jackie Jakab

Lead Attorney

For Clients

Fields of Law

For Lawyers

At the bottom of many websites, you'll find a small disclaimer: "We are not a law firm and are not qualified to give legal advice." If you see this, run the other way. These people can't help you: they're prohibited by law from giving meaningful advice, recommending specific lawyers, or even telling you whether you need a lawyer at all.

There’s no disclaimer here: Atticus is a law firm, and we are qualified to give legal advice. We can answer your most pressing questions, make clear recommendations, and search far and wide to find the right lawyer for you.

Two important things to note: If we give you legal advice, it will be through a lawyer on our staff communicating with you directly. (Don't make important decisions about your case based solely on this or any other website.) And if we take you on as a client, it will be through a document you sign. (No attorney-client relationship arises from using this site or calling us.)

- © 2025 Atticus Law, P.C.

Terms | Privacy | California Privacy | CHD Policy | Disclaimer | This website is lawyer advertising.