Social Security Disability Back Pay: How Much Is Back Pay?

Back pay is exactly what it sounds like — money that pays you back!

In a Social Security disability benefits context, back pay is a lump sum of retroactive payments you get from the Social Security Administration (SSA) in your first check. Disability back pay compensates you for benefits you’re entitled to but haven’t yet received.

This term comes up a lot when we talk about disability benefits and payouts in the United States. It’s a simple concept, but like so much else to do with the law, it gets complicated pretty fast.

This article covers the basics of back pay — what it is, how and when you might get it, and how the SSA calculates back pay benefits.

What is disability back pay?

Back pay is retroactive benefits — the disability benefits you’re entitled to but haven’t yet received.

How much back pay you’ll get depends on many factors, but the most important is which disability program you’re eligible for: Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI).

Depending on your program, you’ll either get back pay for:

The time between the onset of your disability and the time you were first approved for benefits OR

The time between when you applied for disability and the time you were first approved for benefits.

Once you are approved, you’ll get those benefits as one lump sum in your very first benefits check.

How do you get back pay for disability?

There are two major government programs that offer disability benefits and back pay — Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI).

There’s a lot to explain about the differences between SSDI and SSI. Put simply, qualifying for SSDI depends on your work history and how much you’ve paid into Social Security. SSI is much more restrictive, and it’s meant for people with no other source of income.

While both programs offer some back pay, you are entitled to much more through SSDI. Here’s how the SSA calculates back pay on SSI and SSDI.

Back pay on SSI

On SSI, back pay is fairly simple. You’re eligible for benefits and health insurance (Medicaid) from the date you apply.

In practice, this means you’ll get SSI back pay for the time between the date you filed your application and the date your application was approved.

If you’re wondering how to get SSI back pay faster, the only answer is to apply more quickly after you become disabled. You won’t get “more back pay,” but you will become eligible sooner and thus receive more benefits overall.

Remember, there’s no way to get compensated for the time you were disabled but hadn’t yet applied for SSI benefits. That’s why it’s important to figure out which program you qualify for and apply as quickly as you can after the onset of your disability.

SSI back pay in practice

Here’s how SSI back pay might work in a practical situation.

Imagine that you sustained a disability-causing injury on January 1, 2024. You applied for SSI four months later, on May 1, 2024. In another three months, the SSA approved your application, and you got your first check on August 1, 2024.

That check would include three months of back pay, covering the time between your May 1 application date and the date of your first benefits check (August 1).

Back pay on SSDI

On SSDI, you’re entitled to a lot more back pay, but calculating it is much more complex. Here’s what you need to know.

You’re eligible for back pay to cover:

Up to one year after becoming disabled (the SSA calls this your “onset date”), but before you applied for benefits AND

Any time spent waiting for your application to be approved.

However, on SSDI you can never receive:

Back pay for the first five months after you became disabled.

More than one year’s worth of back pay for the time between becoming disabled and applying. (You can get additional back pay for the time between applying and being approved.)

Health insurance (Medicare) for the first 24 months after you become eligible for back pay.

SSDI back pay in practice

If you’re confused about how the SSA calculates SSDI back pay, you’re not alone.

Not only are these waiting periods annoying to deal with and budget for, but they can make it very confusing to try and calculate what you’re entitled to.

Let’s get some clarity with a few more practical examples.

Let’s say…

You were injured and became disabled on January 1, 2023 and

You applied for disability benefits six months later on June 1, 2023 and

You were approved for disability benefits on January 1, 2024.

You will get back pay for the time between the when you became disabled (January 1, 2023) and when you were approved for benefits (January 1, 2024) minus five months.

There are 12 months between January 1 and December 1 — so you receive back pay for six months (12 months - 5 months = 7 months).

There is a limit to the overall back pay you can receive — you can never receive more than one year of back pay from before your application date.

Another example:

You were injured and became disabled on January 1, 2022 and

You applied for disability benefits two years later on January 1, 2024 and

You were approved for disability benefits on December 1, 2024.

Again, you’ll receive back pay between the time you became disabled (January 1, 2022) and the time you were approved for benefits (December 1, 2024). But you can only claim up to a year’s worth of back pay, minus the five-month waiting period, for the period before your application.

You can claim your full back pay amount for the “pending” time between your application and your approval.

There are 24 months between January 1, 2022 and your January 1, 2024 application date — so you would be eligible for 18 months of back pay for this time (24 months - 5 months = 18 months). However, you can only receive one year of back pay max for the period before your application, so you’d receive 12 months of back pay for the pre-application period.

You’d still be entitled to the full amount of back pay between your application and your approval — or the 11 months between January 1, 2022 and December 2024.

So your total back pay amount would be 23 months (12 months pre-application + 11 months post-application).

Next, let’s look at how long it takes to get SSI and SSDI back pay.

When do you get disability back pay?

Finally, a (somewhat) simple answer! You’ll get all the back pay you’re entitled to on your first disability check — which should come one to two months after approval. That’s true whether you qualify for SSI or SSDI.

It’s important to note that back pay doesn’t change the total amount of benefits you’ll receive — it just means you get more benefits at once as a lump sum payment.

There’s no reason to apply for disability later to get “more back pay.” Especially if you’re on SSI, it’s essential to apply for benefits as quickly as possible after you become disabled.

How much back pay will I get?

How much back pay you’ll receive can vary widely based on which disability program you qualify for.

Estimate your disability benefit amount in just a few steps

We'll use the Social Security Administration's formula to estimate your monthly benefit.

Average

monthly check

$1,489

How much back pay will I get from SSI?

SSI payments are often lower than SSDI — the most you can receive from SSI is $943 monthly for a single person or $1,415 for a married couple if you have no other source of income. And as we mentioned, you can only get SSI back pay for the period during which you waited for your application to be approved.

Going back to our example above:

You qualify for SSI and have no other source of income. You’re entitled to $943 per month.

You’re entitled three months of back pay covering the time between when you applied (in May) and when you were granted benefits (in August).

Your first check will include $2,829 of back pay (3 x $943).

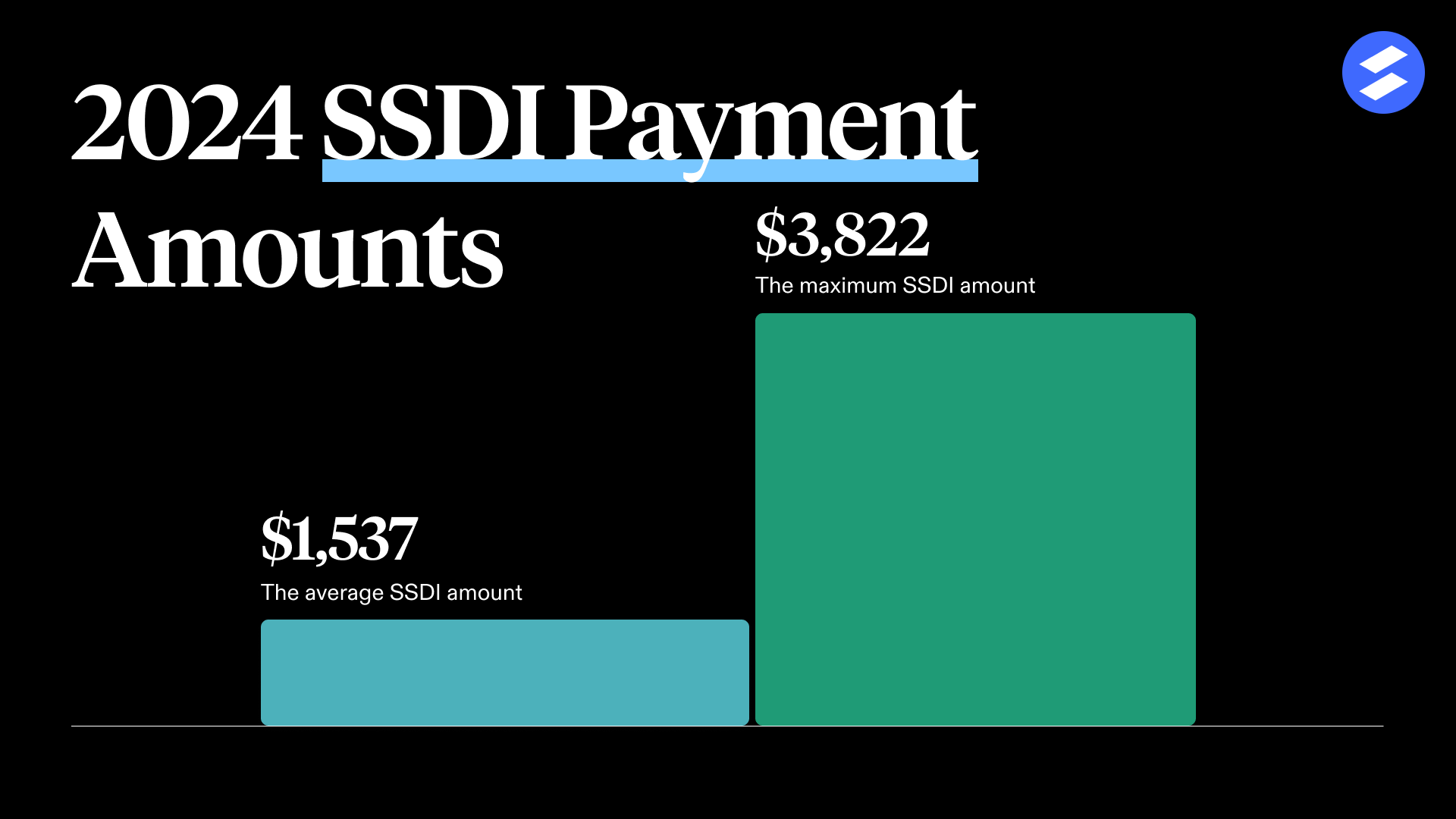

How much back pay will I get for SSDI?

Your SSDI benefits, on the other hand, are determined by how much you’ve already paid into the program by working.

If you’d like to get a rough idea of what you might get, you can access the SSA’s online calculator by making a my Social Security account. Just remember that it’s an estimate, not a guarantee.

Returning to our first SSDI example:

You have a sufficient work history to be eligible for SSDI. You qualify for the average SSDI payment of $1,500 per month.

You’re eligible for seven months of back pay: from your disability onset date (January 2023) to the time you were approved (January 2024) — minus the five months “standard processing time” from the SSA.

Your first check will include $10,500 of back pay (7 x $1,500).

Do I need a lawyer to get disability back pay?

Technically speaking, no — you don’t need a lawyer to get back pay.

But to get back pay, you need to win your case, and you’re three times more likely to succeed if you have legal representation.

Atticus will connect you with a vetted, trustworthy disability lawyer who will give you legal advice tailored to your unique situation. They’ll also help set expectations and assess what your first disability payment might look like.

Atticus helps hundreds of people find the right lawyer daily, and our services are always free. Take our Social Security disability questionnaire and learn more about what benefits you’re entitled to today.

Find disability help in your state

Recommended Articles:

How Much Can I Make on SSDI or SSI in 2024?

How Are SSDI Payments Calculated?

Jackie Jakab

Lead Attorney

For Clients

Fields of Law

For Lawyers

At the bottom of many websites, you'll find a small disclaimer: "We are not a law firm and are not qualified to give legal advice." If you see this, run the other way. These people can't help you: they're prohibited by law from giving meaningful advice, recommending specific lawyers, or even telling you whether you need a lawyer at all.

There’s no disclaimer here: Atticus is a law firm, and we are qualified to give legal advice. We can answer your most pressing questions, make clear recommendations, and search far and wide to find the right lawyer for you.

Two important things to note: If we give you legal advice, it will be through a lawyer on our staff communicating with you directly. (Don't make important decisions about your case based solely on this or any other website.) And if we take you on as a client, it will be through a document you sign. (No attorney-client relationship arises from using this site or calling us.)

- © 2026 Atticus Law, P.C.

Terms | Privacy | California Privacy | CHD Policy | Disclaimer | This website is lawyer advertising.