Unmasking Financial Struggles: Insights on Diverse Challenges Americans Face

Atticus offers free, high-quality disability advice for Americans who can't work. Our team of Stanford and Harvard-trained lawyers has a combined 15+ years of legal experience and has helped over 50,000 Americans apply for disability benefits.

Key takeaways

The average American needs an annual salary of $74,688 to feel financially secure, compared to workers in high-risk jobs ($73,409), individuals with medical conditions ($68,498), and low-income individuals ($51,728).

Individuals with medical conditions (58%) are most likely to experience severe mental health effects due to financial challenges.

Only 27% of individuals with medical conditions are aware of available resources or programs.

Low-income individuals’ biggest “struggle” when trying to access government benefits is proving their eligibility (49%).

Workers in dangerous jobs are the most confident with their level of financial literacy.

Navigating financial realities

When facing financial difficulties, people often experience constant stress and pressure. Worrying about making ends meet, paying bills, and handling debt can affect mental well-being, leading to increased anxiety and depression. That’s why having financial literacy is crucial — it empowers individuals to make informed decisions and navigate tough times more effectively.

To better understand how people with financial hardships and unique challenges manage their finances, we surveyed 1,000 Americans from diverse backgrounds. Our goal is to understand how these factors affect their sense of financial security and awareness, and gain insights into how health, work safety, government assistance, and financial literacy intersect in people’s lives.

Measuring financial security

People measure financial security in various ways, often dependent on their individual circumstances and goals. Some common indicators include having enough savings to cover emergencies, paying bills without stress, having a steady income, being debt-free, and having investments or retirement funds. How secure do individuals with unique challenges feel?

Ultimately, financial security is about feeling confident and in control of one’s financial situation, both in the present and future. Our survey revealed Americans need an average salary of $74,688 to feel financially secure. Workers in dangerous jobs expressed a slightly lower average income need at $73,409, followed by individuals with medical conditions ($68,498) and low-income individuals ($51,728).

We also discovered that financial struggles can significantly impact the mental health of people with medical conditions. A significant 58% of them shared that they face severe mental health effects due to financial challenges. However, more than half of low-income individuals (56%) and those working high-risk jobs (52%) also reported the same.

Interestingly, workers in dangerous jobs also showed the highest confidence in their financial literacy, with 43% expressing a solid understanding of financial matters. This finding suggests that their experience in risky work environments made them more aware of managing their finances, especially considering the potential for income disruptions due to work-related injuries.

Financial journey amidst health challenges

Dealing with financial hardship due to a medical issue can be incredibly challenging, as it involves not only the cost of medical treatments but also potential income disruptions from being unable to work. Medical bills, prescription costs, and other healthcare expenses can quickly accumulate, putting immense strain on individuals and their families.

Our survey revealed that individuals with medical conditions face significant financial challenges, with a staggering 92% reporting difficulties due to the impact on their ability to work. Many of them struggle to save for important future goals like buying a home or funding their children’s education (56%), and nearly half are finding it tough to save for emergencies or retirement (47%) because of their medical conditions leading to a reduction in income (45%).

Interestingly, the findings also showed that women with medical conditions have even more financial struggles than men. They face difficulties in saving money, dealing with high healthcare costs, treatments, and medications, and are at a higher risk of unemployment.

It was concerning to discover that despite their hardships, only 22% sought help from Social Security Disability Insurance (SSDI) and more than half had their SSDI application rejected. More alarmingly, around three-quarters of individuals with medical conditions were not aware of the resources or programs available to support them.

The struggle for assistance

Applying for government benefits can be daunting for individuals, as it often involves complex eligibility requirements, extensive paperwork, and long waiting periods for approval. The application process can be overwhelming, especially for those already facing financial hardships, creating barriers that may prevent some individuals from accessing the much-needed support and assistance they are entitled to

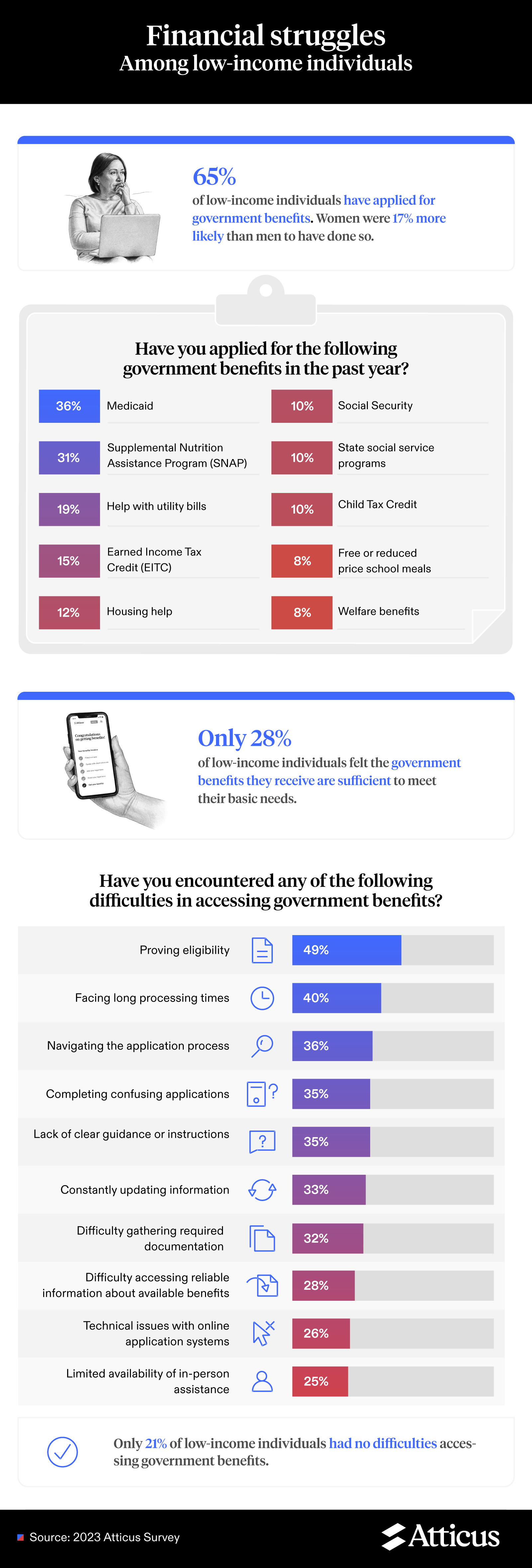

In our survey, we learned that a significant number of low-income individuals (65%) applied for government benefits to get some financial help. Interestingly, more women than men sought this assistance. The most common benefits they applied for were Medicaid, which helps with healthcare costs (36%), followed by the Supplemental Nutrition Assistance Program (SNAP) for food support (31%), and aid for utility bills (19%). However, just slightly more than a quarter of these individuals felt their benefits were enough to cover their basic needs.

Applying for these benefits turned out to be quite challenging for individuals. Almost half of them (49%) struggled to prove eligibility, meaning they had to deal with paperwork and complex requirements. Many had to wait for a long time to get their applications processed (40%) and also found it hard to understand and complete the application process (36%).

Financial journey amid job hazards

For people working in high-risk injury jobs, financial consideration is crucial due to the potential income disruptions resulting from workplace injuries. Having a financial safety net, understanding insurance coverage, and seeking resources to manage unexpected medical expenses become essential steps in preparing for and mitigating the financial impact of workplace accidents or injuries.

The survey results are concerning as they show that workers in high-risk injury jobs face financial vulnerabilities and lack awareness about the risks they encounter. More than half of them (61%) feel unsure about managing their finances during income disruptions caused by work-related injuries, which can lead to financial stress and long-term consequences. Additionally, around one-third (31%) are unaware of the potential dangers they face daily, making them more vulnerable to injuries and financial hardships.

Another worrying finding is that nearly half of these workers (46%) have experienced work absences of up to three months due to work-related injuries. This highlights the need for having enough savings to cover living expenses during such challenging times. When unexpected injuries keep them from working, they still have to pay essential bills like rent, utilities, groceries, and medical costs. An emergency fund that covers at least three months of living expenses can offer much-needed financial security during these unforeseen situations.

Navigating the financial landscape

Financial literacy and access to resources can make a big difference for those facing financial difficulties. When financially literate, people have the knowledge and skills to manage their money wisely, plan for the future, and make informed financial decisions.

Various organizations and community support systems offer help to those going through financial hardship. These resources can include financial counseling, budgeting tools, government programs, nonprofit organizations, and community initiatives that provide financial aid and relief.

Seeking support and education can empower individuals to overcome financial challenges and work towards a more stable and prosperous future.

Methodology

For this campaign, we surveyed 1,000 Americans. Among them, 35% had some medical condition, 35% were low-income individuals, and 30% were high-injury-rate job workers.

About Atticus

Atticus helps Americans in crisis claim government aid and insurance through in-house legal staff, client advocates, and a network of law firms.

Fair use statement

Help us reach Americans in need of assistance by sharing this information for any noncommercial purpose. We just ask that you link back to this article for the full findings and methodology.

Sarah Aitchison

Attorney

For Clients

Fields of Law

For Lawyers

At the bottom of many websites, you'll find a small disclaimer: "We are not a law firm and are not qualified to give legal advice." If you see this, run the other way. These people can't help you: they're prohibited by law from giving meaningful advice, recommending specific lawyers, or even telling you whether you need a lawyer at all.

There’s no disclaimer here: Atticus is a law firm, and we are qualified to give legal advice. We can answer your most pressing questions, make clear recommendations, and search far and wide to find the right lawyer for you.

Two important things to note: If we give you legal advice, it will be through a lawyer on our staff communicating with you directly. (Don't make important decisions about your case based solely on this or any other website.) And if we take you on as a client, it will be through a document you sign. (No attorney-client relationship arises from using this site or calling us.)

- © 2025 Atticus Law, P.C.

Terms | Privacy | California Privacy | CHD Policy | Disclaimer | This website is lawyer advertising.